Warren Buffett Bet On “Ulta Beauty”, Heico in Q2 2024. See How His Portfolio Changed.

Ket Takeaways

- Warren Buffett’s Berkshire Hathaway added new positions in Ulta Beauty and Heico Corp. in the second quarter, according to a regulatory filing released Wednesday.

- Berkshire cut its Apple stake by half in the quarter, though the tech company remains its top holding, accounting for nearly a third of the portfolio.

- Buffett also trimmed positions in Chevron, Floor & Decor and T-Mobile, while exiting holdings of Paramount Global and Snowflake.

- Additions to existing positions included buying shares in Occidental Petroleum and Chubb Limited.

New Additions and Exits In Berkshire Portfolio

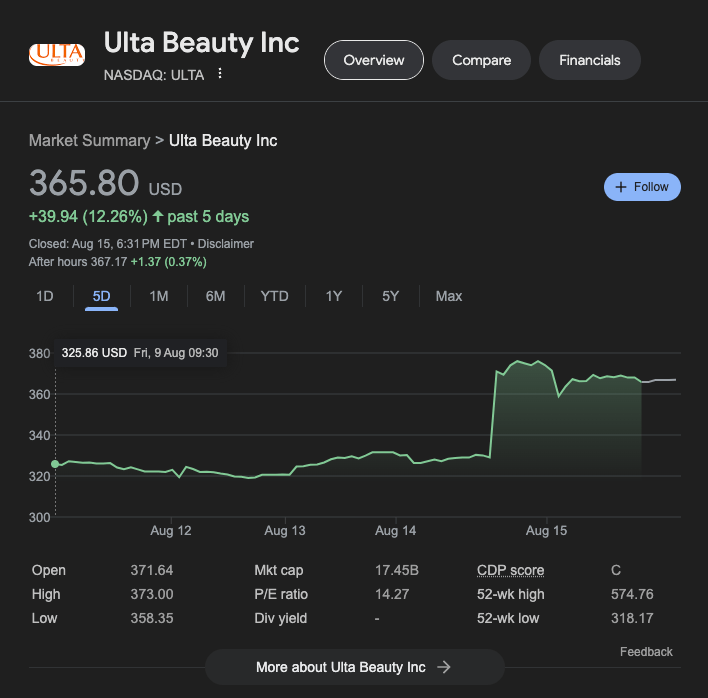

Berkshire Hathaway bought about 690,000 shares of Ulta Beauty valued at roughly $266 million as of June 30. The beauty company’s shares soared 14% in extended trading Wednesday after the stake was revealed.

Buffett also bought about a million shares of Heico Corp., which saw its stock rise nearly 4% in after-hours trading.

The filing reflected the company’s exit from Paramount Global (PARA), a rare bet gone wrong for Buffett. He had admitted to selling all shares in the company for a loss at the Berkshire annual shareholder’s meeting held in May and had offloaded a big part of that stake in the first quarter.2

The company also sold all of its stake in technology firm Snowflake (SNOW). At the end of the first quarter, Berkshire had held 6.1 million shares in the company valued at about $989 million.

Leave a comment